Chicago City Council recently approved a bond measure to help fund affordable housing and economic development programs for the next five years. A total of $1.25 billion was approved for use of general obligation bonds to be used for affordable housing, economic development, and homeownership programs over the next five years. The use of bonds represents a significant shift away from the use of Tax Increment Financing (TIF) for various programs within the city departments. The debt service for the bond program is fully paid out of existing property taxes returning to the city from expiring TIFs. Current projections make it clear that a property tax increase will not result from this bond proposal. To learn more, review Illinois REALTORS® “Issue Summary” regarding the proposal.

After extensive review and discussion by the Chicago Association of REALTORS® Public Policy Coordinating Committee and Board of Directors, the association voted to SUPPORT this ordinance. READ REALTORS® Statement on Position, which was distributed to the media.

On Monday, April 15th, Illinois REALTORS® 2024 President Matt Silver testified at the City Council Finance Committee in support of the shift from TIFs to bonds, and Illinois REALTORS® engaged in direct lobbying of aldermen to support the initiative. READ Matt Silver’s Comments Provided to the Finance Committee.

REALTORS® are committed to encouraging investments throughout the entire City of Chicago and its 77 neighborhoods. The bond measure is an opportunity to attract various real estate development projects that were not previously eligible for financing under the TIF program. It disperses funds in a more equitable manner, which will help develop the South and West Sides, increase rates of homeownership, improve existing housing, and fund critically-needed affordable housing projects in Chicago.

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

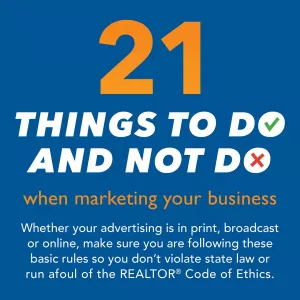

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.