How much mortgage can I afford?

This is the most often asked question from new homebuyers. Are some of your potential homebuyers putting off the decision to buy because they believe they must have 20 percent or more for a down payment? Fact: With assistance programs and certain loan programs, down payments can be even less. The necessary down payment to buy a house can be lower for many buyers than they realize.

Download and share this mortgage finance programs flyer

Here is a list of resources to share with your clients that may include down payment and closing cost assistance.

- Illinois Housing Development Authority (IHDA) programs include:

- Opening Doors

- SmartBuy

- IHDAccess forgivable, deferred and repayable mortgage programs with down payment assistance

- FHA Loans

- Downpayment Plus Programs by the Federal Home Loan Bank of Chicago

- HomeReady Mortgage by Fannie Mae

- Home Possible Mortgage by Freddie Mac

- HomeOne Mortgage by Freddie Mac

- USDA Single Family Housing Guaranteed Loan Program

- VA Home Loan Program

- Finally Home Program to purchase or refinance, by the Illinois State Treasurer’s Office

- Senior Housing Resources

Among the things to consider when buying a home are mortgage interest rates. The lower the rate, the more buying power you have. Find the most current interest rates from Freddie Mac.

Now is a good time to sell a home

Download these talking points to help you prepare for your next listing presentation. With limited inventory and low interest rates, there are may reasons to share with your clients on why now is a good time to sell a home including:

- homes are selling quickly

- home prices remain strong

- mortage interest rates are historically low

- now is the time to move up to the home of your dreams

Other popular questions include:

- How low will mortgage rates go?

- Can you use your 401(k) to buy a house?

- What is the process for buying a house?

- What is the minimum credit score to buy a house?

Here are housing affordability resources to share:

Homeownership: How Much Can I Afford

Download this guide to help clients determine if they can qualify for a mortgage loan, learn about home affordability and closing costs.

Homeownership: Understanding the Cost

This guide helps clients understand the costs of owning a home beyond the mortgage and taxes and how to budget for them.

Freddie Mac housing affordability videos

Learn about affordable solutions for your borrowers with low to moderate incomes, educational resources for prospective borrowers, and solutions for homeowner recovery from the economic impact of COVID-19.

Find out what Illinois is doing in regards to housing preservation, housing counseling and low down payment options to share with your clients.

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

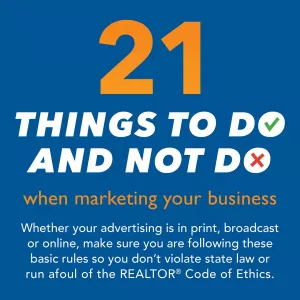

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.